题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

The IT industry in developing so rapidly that almot nything_____ is written about it wil

A. as

B. which

C. that

D. what

答案

答案

请输入或粘贴题目内容

搜题

请输入或粘贴题目内容

搜题

拍照、语音搜题,请扫码进入小程序

拍照、语音搜题,请扫码进入小程序

题目内容

(请给出正确答案)

题目内容

(请给出正确答案)

A. as

B. which

C. that

D. what

答案

答案

更多“The IT industry in developing so rapidly that almot nything_____ is written about it wil”相关的问题

更多“The IT industry in developing so rapidly that almot nything_____ is written about it wil”相关的问题

第1题

ll be out of date by the time it is printed.

A.as

B.which

C.That

D.what

第2题

A. Toys are playing an increasingly important role in shaping a child’s character.

B. The toy industry has witnessed great leaps in technology in recent years.

C. The craftsmanship in toy making has remained essentially unchange

D. Toys have remained basically the same all through the centuries.

第3题

A.no producer can cover his costs of production at that price

B.the quantity supplied exceeds the quantity demanded at that price

C.producers are leaving the industry

D.consumers are willing to buy all the units produced at that price

E.quantity demanded exceeds quantity supplied at that price

第4题

Because Industry X is characterized by perfect competition, every firm in the industry is earning zero economic profit. If the product price falls, no firm can survive. Do you agree or disagree? Discuss

第5题

A.希望工程(HOPE工程)

B.卓越工程(SUPER工程)

C.创新工程(INNOVATION工程)

D.产业工程(INDUSTRY工程)

第6题

函数至少在取a、b、c、d四个参数值时与U形平均成本曲线相一致。

Suppose the long - run total cost function for an industry is given by the cubic equation TC =a+bq+cq2+dq3. Show (using calculus ) that this total cost function is consistent with a U - shaped average cost curve for at least some values of a, b, c, d.

第7题

To encourage an industry to produce at the socially optimal level, the government should impose a unit tax on output equal to the marginal cost of production. True or false? Explain.

第8题

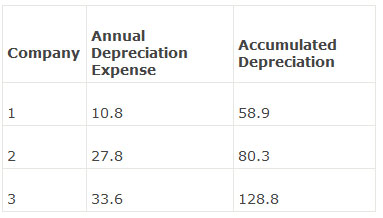

An analyst gathers the following information ($ millions) about three companies operating in the same industry:

Although the companies have different levels of sales and assets, they are all experiencing sales growth at about the same rate and use the same type of equipment in the manufacturing process.All three companies also use the same depreciation method.Which company is least likely to require major capital expenditures in the near future? Company:

A.1.

B.2.

C.3.

第9题

Supporters of the new supersystems argue that these mergers will allow f or substantial cost reductions and better coordinated service. Any threat of monopoly, they argue, is removed by fiercecompetition from trucks. But many shippers complain that for heavy bulk commodities traveling long distances, such as coal, chemicals, and grain, trucking is too costly and the railroads therefore have them by the throat. The vast consolidation within the rail industry means that most shippers are served by only one rail company. Railroads typically charge such "captive" shippers 20 to 30 percentmore than they do when another railroad is competing for the business. Shippers who feel they are being overcharged have the right to appeal to the federal government’s SurfaceTransportation Board for rate relief, but the process is expensive, time-consuming, and will work only in truly extreme cases.

Railroads justify rate discrimination against captive shippers on the grounds that in the long run it reduces everyone’s cost. If railroads charged all customers the same average rate, they argue, shippers who have the option of switching to trucks or other forms of transportation would do so, leaving remaining customers to shoulder the cost of keeping up the line. It’s a theory to which many economists subscribe, but in practice it often leaves railroads in the position of determining which companies will flourish and which will fail. "Do we really want railroads to be the arbiters of who wins and who loses in the marketplace?" asks Martin Bercovici, a Washington lawyer who frequently represents shippers.

Many captive shippers also worry they will soon be hit with a round of huge rate increases. The railroad industry as a whole, despite its brightening fortunes, still does not earn enough to cover the cost of the capital it must invest to keep up with its surging traffic. Yet railroads continue to borrow billions to acquire one another, with Wall Street cheering them on. Consider the $10.2 billion bid by Norfolk Southern and CSX to acquire Conrail this year. Conrail’s net railway operating income in 1996 was just $427 million, less than half of the carrying costs of the transaction. Who’s going to pay for the rest of the bill? Many captive shippers fear that they will, as Norfolk Southern and CSX increase their grip on the market.

1. According to those who support mergers, railway monopoly is unlikely because ().

A.cost reduction is based on competition

B.services call for cross-trade coordination

C.outside competitors will continue to exist

D.shippers will have the railway by the throat

2. What is many captive shippers’ attitude towards the consolidation in the rail industry?

A.Indifferent.

B.Supportive.

C.Indignant.

D.Apprehensive.

3. It can be inferred from Paragraph 3 that ().

A.shippers will be charged less without a rival railroad

B.there will soon be only one railroad company nationwide

C.overcharged shippers are unlikely to appeal for rate relief

D.a government board ensures fair play in railway business

4. The word "arbiters" (Line 7, Paragraph 4) most probably refers to those ().

A.who work as coordinators

B.who function as judges

C.who supervise transactions

D.who determine the price

5. According to the text, the cost increase in the rail industry is mainly caused by ().

A.the continuing acquisition

B.the growing traffic

C.the cheering Wall Street

D.the shrinking market

第10题

The Committee of Sponsoring Organisations (COSO) of the Treadway Commission is an American voluntary, private sector organisation and is unconnected to government or any other regulatory authority. It was established in 1985 to help companies identify the causes of fraudulent reporting and to create internal control environments able to support full and accurate reporting. It is named after its fi rst chairman, James Treadway, and has issued several guidance reports over the years including important reports in 1987, 1992 and 2006.

In 2009, COSO issued new ‘Guidance on monitoring internal control systems’ to help companies tighten internal controls and thereby enjoy greater internal productivity and produce higher quality reporting. The report, written principally by a leading global professional services fi rm but adopted by all of the COSO members, noted that ‘unmonitored controls tend to deteriorate over time’ and encouraged organisations to adopt wide ranging internal controls. It went on to say that, the ‘assessment of internal controls [can] ... involve a signifi cant amount of ... internal audit testing.’

After its publication, the business journalist, Mark Rogalski, said that the latest report contained ‘yet more guidance from COSO on how to make your company less productive by burdening it even more with non-productive things to do’ referring to the internal control guidance the 2009 report contains. He said that there was no industry sector-specifi c advice and that a ‘one-size-fi ts-all’ approach to internal control was ‘ridiculous’. He further argued that there was no link between internal controls and external reporting, and that internal controls are unnecessary for effective external reporting.

Another commentator, Claire Mahmood, wrote a reply to Rogalski’s column pointing to the views expressed in the 2009 COSO report that, ‘over time effective monitoring can lead to organisational effi ciencies and reduced costs associated with public reporting on internal control because problems are identifi ed and addressed in a proactive, rather than reactive, manner.’ She said that these benefi ts were not industry sector specifi c and that Rogalski was incorrect in his dismissal of the report’s value. She also said that although primarily concerned with governance in the USA, the best practice guidance from COSO could be applied by companies anywhere in the world. She said that although the USA, where COSO is based, is concerned with the ‘rigid rules’ of compliance, the advice ought to be followed by companies in countries with principles-based approaches to corporate governance because it was best practice.

Required:

(a) Distinguish between rules-based and principles-based approaches to internal control system compliance as described by Claire Mahmood and discuss the benefi ts to an organisation of a principles-based approach. (7 marks)

(b) Mr Rogalski is sceptical over the value of internal control and believes that controls must be industry-specifi c to be effective. Required: Describe the advantages of internal control that apply regardless of industry sector and briefl y explain the meaning of the statement, ‘unmonitored controls tend to deteriorate over time’. Your answer should refer to the case scenario as appropriate. (10 marks)

(c) The COSO report explains that ‘assessment of internal controls [can] ... involve a signifi cant amount of ... internal audit testing.’ Required: Defi ne ‘internal audit testing’ and explain the roles of internal audit in helping ensure the effectiveness of internal control systems. (8 marks)